Discover the top financial advisors near you in 2025. Learn how to choose the right advisor, compare services, and make smart money decision

Whether you’re planning for retirement, investing for the first time, or managing a large portfolio, having the right financial advisor can make a huge difference.

A good advisor can help you:

- Create a customized investment strategy

- Reduce taxes legally

- Grow wealth while managing risk

- Achieve long-term financial goals

In this guide, we’ll show you how to find the top financial advisors near you, what to look for, and which online tools can connect you with the right expert.

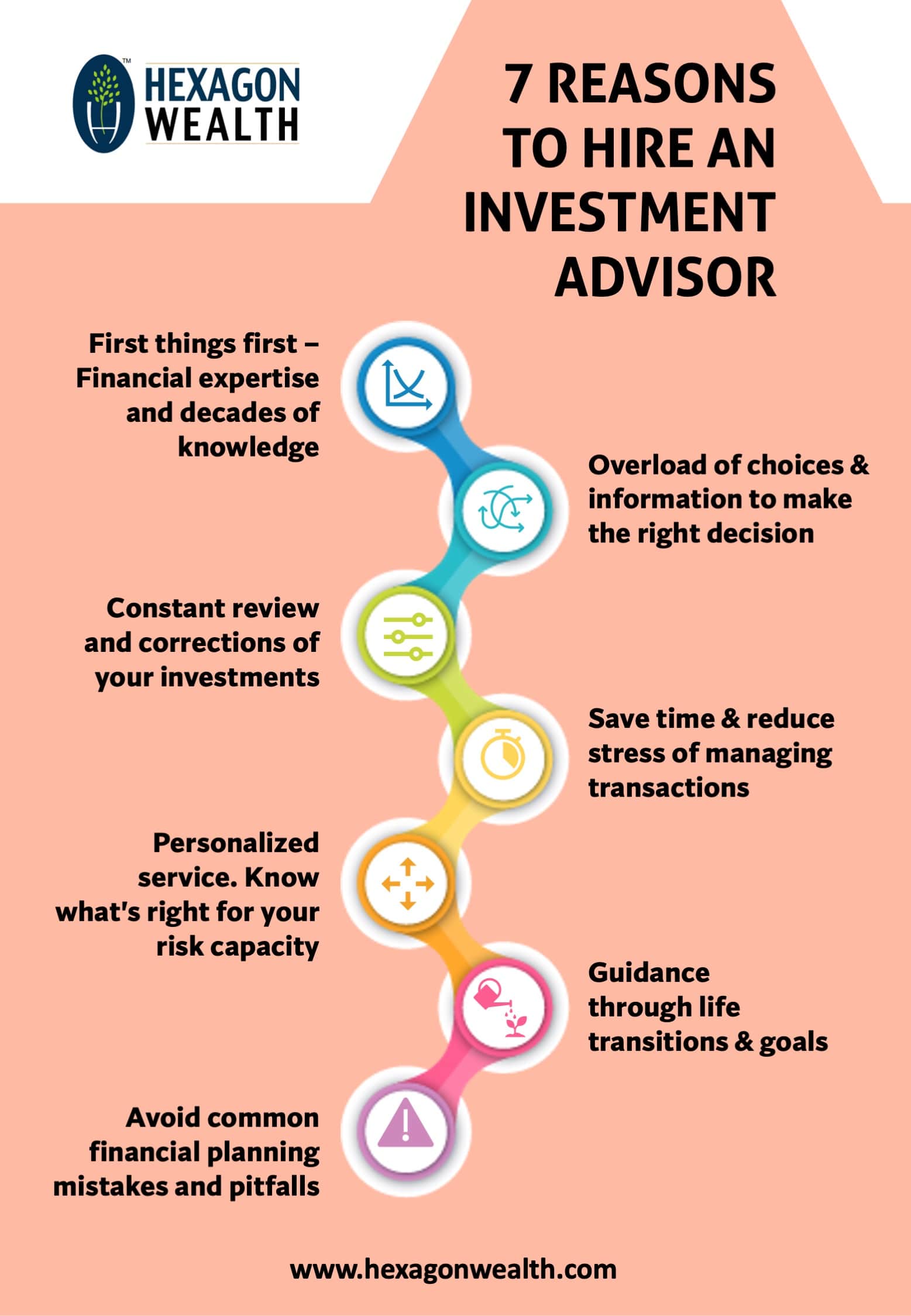

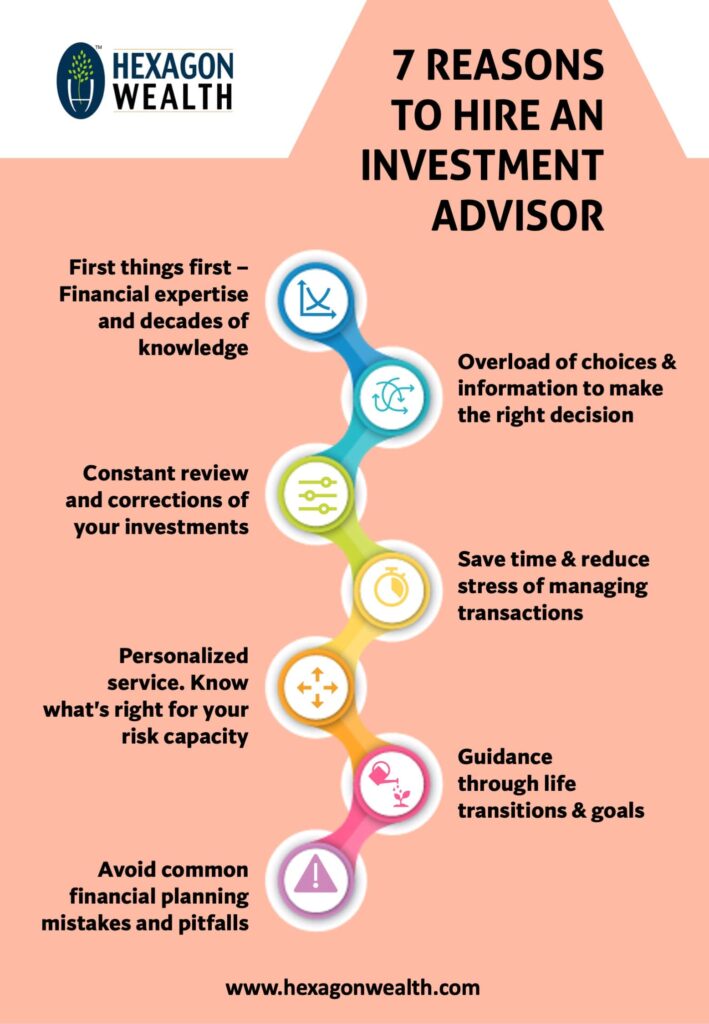

Why You Need a Financial Advisor

Many people think financial advisors are only for the wealthy, but that’s not true. Here’s why you might need one:

- Retirement Planning: Ensure you save enough and invest wisely.

- Debt Management: Create strategies to pay off loans faster.

- Tax Optimization: Legally reduce your tax bill.

- Investment Growth: Make informed decisions with professional guidance.

- Estate Planning: Secure your legacy for future generations.

How to Find Top Financial Advisors Near You

Finding the right advisor isn’t just about location — it’s about expertise, trust, and transparency. Here’s how to start:

1. Use Trusted Advisor Directories

- NAPFA (National Association of Personal Financial Advisors) – Lists fee-only fiduciary advisors who put clients’ interests first.

- CFP Board – Search for certified financial planners with verified credentials.

- XY Planning Network – Ideal for younger clients and virtual planning services.

2. Read Reviews and Testimonials

Check platforms like Google Reviews, Yelp, and LinkedIn to see real client feedback.

3. Check Credentials

Look for designations such as:

- CFP® (Certified Financial Planner)

- CFA (Chartered Financial Analyst)

- CPA (Certified Public Accountant) with a personal finance specialty

4. Compare Fee Structures

Common models include:

- Fee-Only: Paid directly by you, no commissions.

- Commission-Based: Paid when selling products (beware of conflicts).

- Hourly or Flat Fee: Pay for specific advice or planning.

5. Interview Multiple Advisors

Schedule free consultations to ask:

- What’s your investment philosophy?

- Do you have experience with clients like me?

- How do you charge for services?

Benefits of Hiring a Local Financial Advisor

While virtual advisors are great, working with a local expert can offer:

- Face-to-Face Meetings – Build a stronger relationship.

- Local Market Insights – Understand real estate, tax laws, and investment trends in your area.

- Networking – Access to local legal and accounting professionals.

Top-Rated Financial Advisors Near You (U.S. Examples)

While your exact options will vary by location, here are highly rated U.S. firms often featured in Barron’s and Forbes rankings:

- Vanguard Personal Advisor Services – Great for long-term investors.

- Fisher Investments – Known for personalized portfolio management.

- Edward Jones – Strong local presence and in-person service.

- Charles Schwab Advisory – Combines online tools with human advisors.

(If you’re outside the U.S., check regional directories for top-rated advisors in your country.)

Questions to Ask Before Hiring an Advisor

- Are you a fiduciary? (They must act in your best interest.)

- What is your investment philosophy?

- How do you measure success for clients?

- What is your communication style and frequency?

- Can you provide client references?

Alternatives to Local Advisors

- Robo-Advisors like Betterment or Wealthfront – Low fees and automated investing.

- Virtual Financial Advisors – Offer personalized advice via Zoom or phone.

Conclusion

Finding the top financial advisor near you takes research, but the payoff is worth it. A great advisor can help you make better money decisions, grow your wealth, and secure your future.

Whether you choose a local in-person advisor or a virtual expert, make sure they are qualified, transparent, and aligned with your goals. The right partnership can help you achieve financial confidence for years to come.