As a freelancer, you have the freedom to be your own boss, set your schedule, and work on projects that excite you. But with great freedom comes great responsibility—especially when it comes to taxes. Unlike traditional employees, freelancers are responsible for handling their own taxes, which can sometimes feel overwhelming. However, one of the benefits of freelancing is the ability to take advantage of various tax deductions that can help reduce your taxable income.

In this article, we’ll walk you through the most common tax deductions available for freelancers, ensuring you can keep more of your hard-earned money.

1. Business Expenses: A Wide Range of Deductions

Freelancers are allowed to deduct many business-related expenses that are necessary to run your freelance operation. These expenses can help reduce your taxable income, which ultimately means less tax owed.

Examples of Business Expenses:

- Software and Tools: If you use software for your freelance work (like design programs, accounting software, or project management tools), those expenses can be deducted.

- Marketing and Advertising: Any costs related to promoting your freelance services, such as ads, business cards, and website hosting, can be deducted.

- Professional Fees: Membership fees for industry associations, trade organizations, or licenses needed for your freelance business are deductible.

- Bank Fees: If you have a business bank account, you can deduct account maintenance fees and other business-related banking charges.

What to Remember:

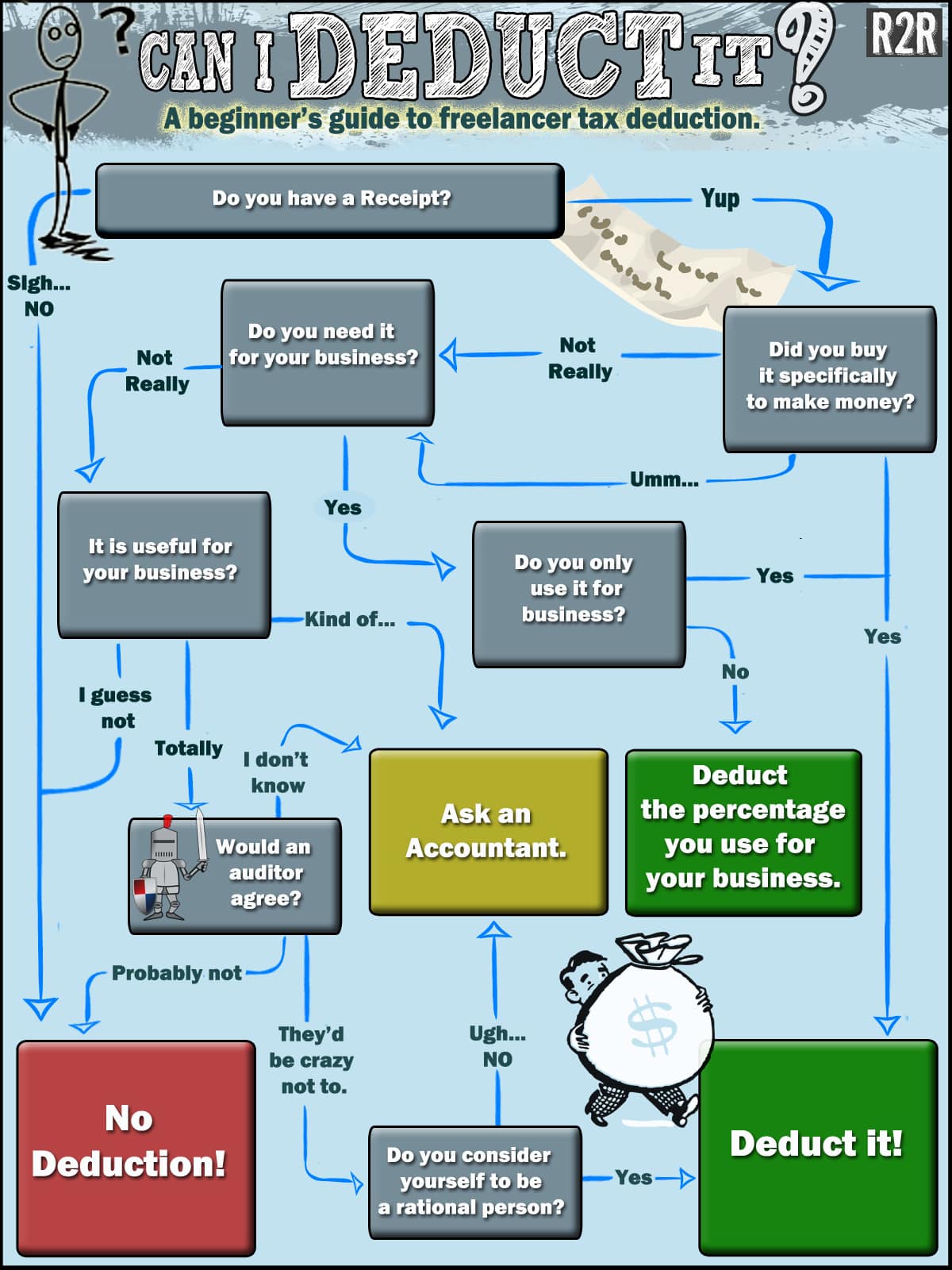

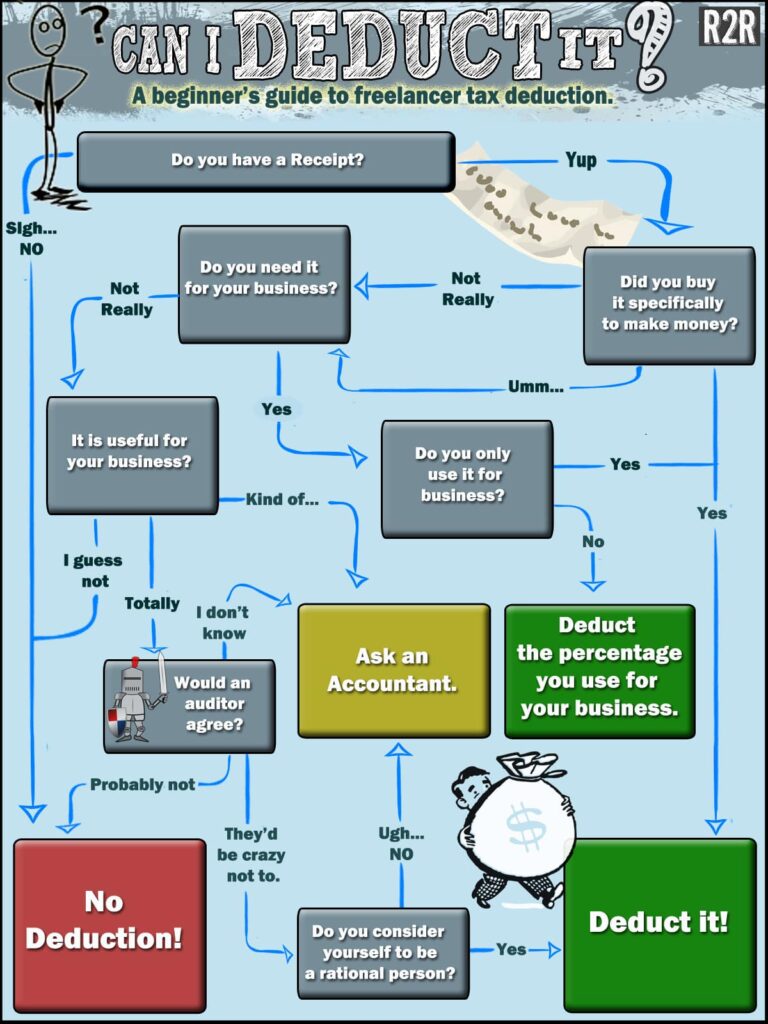

For something to qualify as a business expense, it must be ordinary and necessary for your work. Keep detailed records and receipts for every expense you plan to deduct.

2. Home Office Deduction

One of the most commonly claimed tax deductions for freelancers is the home office deduction. If you use part of your home exclusively and regularly for business, you can deduct a portion of your rent, mortgage interest, utilities, and home insurance.

How It Works:

There are two ways to calculate the home office deduction:

- Simplified Method:

You can deduct $5 per square foot of your home office, up to 300 square feet (maximum $1,500). - Regular Method:

You calculate the percentage of your home used for business. For example, if your office space is 200 square feet in a 1,000 square foot home, your deduction would be 20% of your total home expenses (rent, utilities, internet, etc.).

Requirements:

- The space must be used exclusively and regularly for business purposes. You cannot use it for personal activities.

- If you work from a dedicated office in your home, this may be a substantial deduction.

3. Equipment and Supplies

Freelancers can deduct the cost of buying office equipment and supplies, such as:

- Computers and Laptops: If you purchase new tech to perform your freelance work, you can deduct either the full cost or depreciate the cost over several years.

- Office Furniture: Desks, chairs, and other office furnishings used for your freelance business qualify.

- Office Supplies: Pens, paper, printer ink, and other consumables used in the course of your work are deductible.

What’s the Catch?

If the equipment is used both for personal and business purposes, you can only deduct the portion that’s used for business. For example, if you use a laptop 70% of the time for business, you can deduct 70% of the cost.

4. Travel and Meals

As a freelancer, traveling for work may be a regular part of your business. Whether you’re going to meetings, attending conferences, or visiting clients, travel-related expenses can often be deducted.

What You Can Deduct:

- Travel Expenses: Airfare, train tickets, car rental, mileage, and even gas are deductible if the travel is for business.

- Lodging: Hotel stays for business trips are deductible.

- Meals: You can deduct 50% of the cost of meals while traveling for business. This includes meals during client meetings, business conferences, or while traveling to a work destination.

Special Notes:

- For meals, the 50% rule applies, but if you provide meals for employees or clients, you may be able to deduct the full amount in some cases.

- Keep detailed records, including receipts and the business purpose of each trip or meal.

5. Health Insurance Premiums

If you’re a freelancer, you may be able to deduct the cost of your health insurance premiums from your taxable income, provided you meet certain conditions.

Eligibility Requirements:

- You must be self-employed and not eligible for other coverage (such as through a spouse’s employer).

- The deduction applies to your health insurance premiums, as well as dental and long-term care insurance premiums.

- The deduction is taken above the line, which means it reduces your taxable income directly and is not subject to itemized deductions.

6. Retirement Contributions

As a freelancer, you are responsible for saving for your retirement, but you can also deduct contributions to retirement plans.

Types of Plans You Can Contribute To:

- SEP-IRA (Simplified Employee Pension): Allows you to contribute up to 25% of your income (up to $61,000 for 2023).

- Solo 401(k): If you’re a solo freelancer, this plan allows for higher contribution limits, up to $22,500 (or $30,000 if you’re 50 or older) in employee deferrals, plus additional employer contributions up to 25% of your income.

- Traditional IRA: You can contribute up to $6,500 (or $7,500 if you’re 50 or older) and potentially deduct that amount from your taxable income.

By contributing to a retirement plan, you reduce your current tax liability while saving for your future.

7. Self-Employment Taxes (The 50% Deduction)

Freelancers are required to pay self-employment taxes (Social Security and Medicare taxes) on their earnings, but you can deduct 50% of your self-employment tax on your tax return.

Why It Matters:

While this deduction does not reduce your overall self-employment tax liability, it does reduce your taxable income, which can lower the amount of income tax you owe.

8. Education and Training

Freelancers can deduct the cost of education and training related to their business. This includes courses, certifications, workshops, books, and online resources that help you improve your skills or learn new ones that enhance your ability to earn income.

What Qualifies as Deductible:

- Workshops, webinars, and courses related to your field of freelance work.

- Educational materials such as books, software, or subscriptions to professional journals.

What Doesn’t Qualify:

- Personal hobbies or courses unrelated to your freelance business.

9. Depreciation of Assets

If you purchase major assets, such as a vehicle or expensive equipment for your freelance business, you may be able to deduct the cost over several years through depreciation.

How It Works:

- Depreciation allows you to deduct the cost of an asset over time, typically over a period of years.

- You can also consider Section 179 of the tax code, which lets you deduct the full cost of qualifying equipment or property in the year you buy it (up to certain limits).

Conclusion

Navigating taxes as a freelancer can be complex, but taking advantage of the many deductions available can help significantly reduce your taxable income and save you money. Whether it’s business expenses, home office deductions, or contributions to retirement accounts, these tax breaks can make a huge difference in your financial situation.

To maximize your deductions:

- Keep organized records of all business-related expenses.

- Consult with a tax professional or accountant who specializes in self-employment to ensure you’re taking full advantage of all eligible deductions.

By staying proactive and diligent with your taxes, you’ll keep more of your hard-earned income and continue growing your freelance business with confidence.