Start planning for your future now! Explore essential retirement planning tips for Millennials, including savings strategies, investment options, and ways to secure a comfortable retirement.

As a Millennial, retirement might seem like a distant reality—something that’s decades away. However, starting early is one of the most important things you can do to ensure financial security in your later years. The earlier you begin planning for retirement, the more time your money has to grow, allowing you to take advantage of compound interest and secure the lifestyle you want in your golden years.

While the idea of retirement planning can feel overwhelming, it doesn’t have to be. By breaking it down into manageable steps, you can start taking action today. This guide will help Millennials understand the key aspects of retirement planning, offering practical tips and strategies that will help you build a strong financial foundation for the future.

1. Start Early: Time is Your Greatest Ally

The most important tip for Millennials when it comes to retirement planning is simply to start now. The earlier you start saving, the better off you’ll be. Here’s why:

The Power of Compound Interest:

Compound interest is when your investment earnings (interest, dividends, etc.) earn additional earnings. It’s a powerful tool for growing wealth, especially over long periods. For example, if you save $5,000 a year for 30 years at a 7% annual return, you’d end up with around $500,000 (compared to just $150,000 if you were to save the same amount but only for 15 years). The earlier you start, the more you benefit from compound interest.

How to Get Started:

- Even small contributions add up over time. Setting aside just $100 or $200 per month early on can make a huge difference in the long run.

- Automate your savings to make it easier. Set up automatic transfers from your checking account to a retirement account.

2. Set Clear Retirement Goals

Knowing what you’re saving for is crucial. While “retirement” might sound like a vague concept, creating clear and tangible goals will help guide your strategy.

Consider Your Desired Lifestyle:

- What type of retirement do you envision? Will you travel, or do you want to stay close to home? Do you want to retire early or work part-time during retirement?

- How much money will you need to support that lifestyle? Understanding your expected expenses can help you calculate how much you should aim to save.

Use Retirement Calculators:

There are several online calculators that help estimate how much you should be saving for retirement based on your goals. Tools like Fidelity’s Retirement Score or Vanguard’s Retirement Savings Calculator can help you understand how much you need to save monthly.

3. Contribute to Employer-Sponsored Retirement Accounts (401(k), 403(b))

If your employer offers a retirement savings plan like a 401(k) or 403(b), take full advantage of it. These plans allow you to save pre-tax income for retirement, which can lower your taxable income now while building wealth for the future.

Employer Match:

Many employers offer a matching contribution. For example, if you contribute 5% of your salary, your employer might match that with an additional 5%. This is essentially free money that you don’t want to leave on the table.

Maximizing Contributions:

- In 2023, the contribution limit for 401(k) plans is $22,500, with an additional $7,500 catch-up contribution if you’re 50 or older.

- Aim to contribute at least enough to get the full employer match, but if possible, try to max out your 401(k) contributions each year.

4. Consider Individual Retirement Accounts (IRAs)

In addition to employer-sponsored retirement accounts, you can open an Individual Retirement Account (IRA), either a Traditional IRA or a Roth IRA.

Traditional IRA:

- Contributions are made pre-tax, reducing your taxable income in the current year.

- Taxes are paid when you withdraw money in retirement (typically at a lower tax rate).

Roth IRA:

- Contributions are made with after-tax dollars, meaning you won’t receive a tax break now.

- The major advantage is that your withdrawals in retirement are tax-free.

IRA Benefits:

- IRAs offer flexibility in how you invest your money and provide opportunities for diversification.

- You can contribute to both a 401(k) and an IRA in the same year, but there are limits to how much you can contribute to each.

5. Automate Your Savings and Investments

Life is busy, and saving for retirement can sometimes fall to the bottom of your to-do list. One of the best ways to stay on track is to automate your savings and investments.

Automatic Contributions:

Set up automatic deductions from your paycheck or checking account to go directly into your retirement accounts. This way, you won’t be tempted to spend the money, and you’ll consistently contribute to your future.

Automatic Investing:

Many robo-advisors and investment platforms allow you to automate your investment strategy. For example, platforms like Betterment or Wealthfront create portfolios based on your risk tolerance and automatically adjust your investments over time.

6. Diversify Your Investments

Diversification means spreading your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce risk.

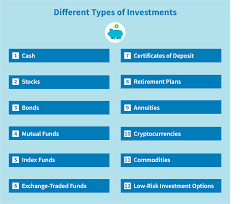

Types of Investments:

- Stocks: Stocks tend to provide higher returns over time, but they are riskier in the short term. Consider investing in index funds or exchange-traded funds (ETFs), which offer exposure to a wide range of companies and sectors.

- Bonds: Bonds are generally less risky than stocks and provide a steady stream of income. As you get closer to retirement, you may want to increase your bond allocation for more stability.

- Real Estate: Real estate can be a good long-term investment, either through direct property ownership or real estate investment trusts (REITs).

Rebalancing:

Over time, your portfolio may become unbalanced due to the market’s ups and downs. Rebalancing ensures that your asset allocation stays aligned with your risk tolerance and retirement goals.

7. Plan for Healthcare Costs in Retirement

Healthcare is one of the biggest expenses retirees face. As a Millennial, you have the advantage of time on your side, but it’s important to start planning for healthcare costs early.

Health Savings Accounts (HSAs):

If you’re enrolled in a high-deductible health plan (HDHP), consider contributing to a Health Savings Account (HSA). Contributions are tax-deductible, and the money grows tax-free. Best of all, you can use it for healthcare expenses during retirement.

Medicare:

Medicare begins at age 65, but it doesn’t cover all healthcare expenses. Having a dedicated health savings fund can help you cover costs not included in Medicare.

8. Avoid Lifestyle Inflation

As your salary increases, it’s easy to let your spending increase as well. However, one of the biggest financial pitfalls Millennials face is lifestyle inflation—the tendency to spend more as you earn more.

Live Below Your Means:

Instead of upgrading your lifestyle every time you get a raise, consider increasing your retirement contributions or saving the extra money. This habit can help you build a larger nest egg over time.

9. Monitor Your Retirement Progress

Periodically reviewing your retirement savings is essential. Make sure you’re on track to meet your goals and adjust your strategy if necessary.

Track Your Net Worth:

Use tools like Mint or Personal Capital to track your savings and investment progress. These apps can also help you budget and see where your money is going, which can help you make adjustments if needed.

Conclusion

Retirement planning may seem daunting, but with the right approach, Millennials can set themselves up for a financially secure future. By starting early, automating your savings, and diversifying your investments, you can take full advantage of the opportunities available to you. Remember, retirement might seem far off, but time is on your side—make sure you take action now so you can enjoy a comfortable, worry-free retirement later.

It’s never too early to start planning. Set your retirement goals, make your contributions, and let compound interest work its magic. Your future self will thank you!