Introduction

When purchasing insurance—whether it’s health, auto, or homeowners—one important decision is choosing your insurance deductible. Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing the right deductible affects your monthly premiums, out-of-pocket costs, and even your overall financial stability.

Making the wrong choice could mean overpaying for coverage or struggling with unexpected bills. In this guide, we’ll walk you through how deductibles work, factors to consider when choosing one, and strategies to balance cost and protection.

What Is an Insurance Deductible?

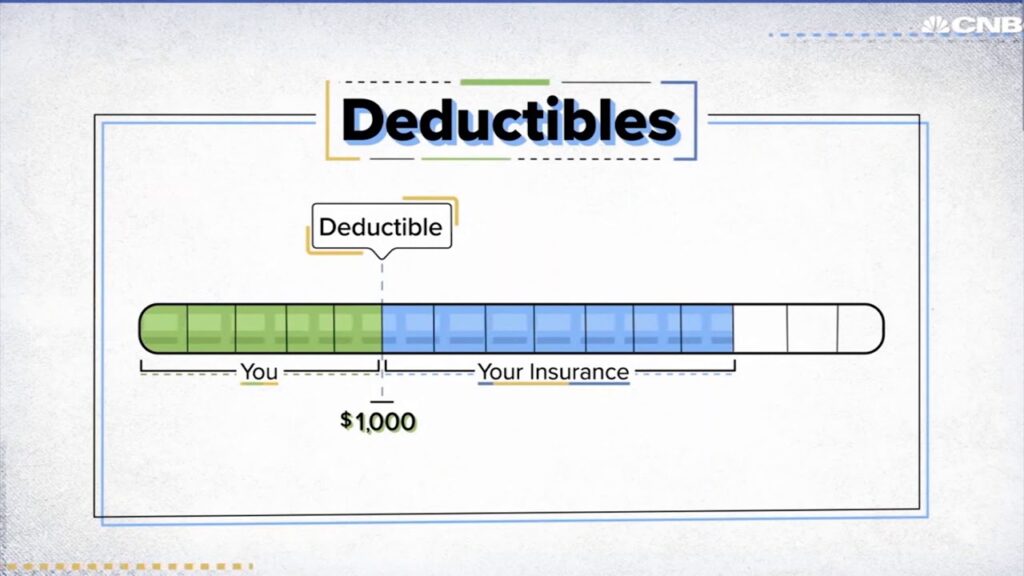

An insurance deductible is a fixed amount you must pay for covered expenses before your insurance provider starts paying.

For example:

- If your auto policy has a $500 deductible and you have $2,000 in repair costs after an accident, you pay $500, and your insurer covers the remaining $1,500.

- If your health insurance deductible is $1,000, you must pay that amount for covered medical services before your plan begins to share costs.

Types of Deductibles:

- Fixed Dollar Deductible – A specific dollar amount (e.g., $500 or $1,000).

- Percentage Deductible – Common in property insurance, calculated as a percentage of the insured value.

How Deductibles Affect Premiums

Deductibles and premiums have an inverse relationship:

- Higher Deductible → Lower Premiums

- Lower Deductible → Higher Premiums

Example:

If you raise your auto insurance deductible from $500 to $1,000, you might lower your annual premium by 10–20%. However, you’ll pay more out-of-pocket in the event of a claim.

According to the Insurance Information Institute, choosing a higher deductible could save you up to 25% on premiums.

Factors to Consider When Choosing a Deductible

1. Your Financial Situation

Ask yourself: Could I afford my deductible if I had to pay it tomorrow?

- If you have strong savings, a higher deductible can save you money on premiums.

- If you live paycheck to paycheck, a lower deductible might be safer to avoid financial strain after an unexpected event.

2. Risk Tolerance

- Low risk tolerance: You prefer paying a bit more monthly for peace of mind.

- High risk tolerance: You’re comfortable with higher out-of-pocket costs for lower premiums.

3. Type of Insurance

- Auto Insurance: Consider driving habits, accident history, and vehicle value.

- Health Insurance: Evaluate your annual medical expenses and preventive care needs.

- Homeowners Insurance: Factor in location risks like floods, earthquakes, or hurricanes.

4. Claim Frequency

If you rarely file claims, a higher deductible could save you money over time. But if claims are likely, a lower deductible might be more cost-effective.

Pros and Cons of High vs. Low Deductibles

| Deductible Type | Pros | Cons |

|---|---|---|

| High Deductible | Lower premiums, potential long-term savings | Higher out-of-pocket costs at claim time |

| Low Deductible | Lower upfront claim costs, predictable expenses | Higher monthly premiums, possible overpayment if claims are rare |

How to Decide on the Right Deductible – Step-by-Step

- Review Your Budget – Determine how much you can comfortably pay in an emergency.

- Get Multiple Quotes – Compare premium differences for various deductible levels.

- Calculate Potential Savings – See if premium savings outweigh the risk of paying more out-of-pocket.

- Consider Long-Term Costs – If you go several years without claims, a higher deductible can mean significant savings.

- Reevaluate Annually – Adjust your deductible as your financial situation changes.

Common Mistakes to Avoid

- Choosing the Lowest Deductible by Default – This can lead to overpaying in premiums.

- Ignoring Inflation & Repair Costs – Replacement costs can rise, making your deductible harder to cover.

- Not Reading Policy Details – Some policies have separate deductibles for specific claims (e.g., wind damage, theft).

Expert Tips for Choosing the Best Deductible

- Bundle Policies – Some insurers offer discounts if you have multiple policies, reducing premium costs even with a lower deductible.

- Use Emergency Funds – Keep a savings buffer specifically for covering deductibles.

- Leverage Preventive Measures – For home and auto, maintenance and safety devices can reduce the likelihood of claims.

Internal Resources You Might Like

- How to File an Insurance Appeal

- Best Insurance Companies for Seniors

- Compare Health Insurance Marketplace Plans

External Resources

- Insurance Information Institute – Deductibles Explained

- National Association of Insurance Commissioners – Consumer Guide

Conclusion

Choosing the right insurance deductible is all about balancing risk and cost. A higher deductible can lower premiums but requires financial readiness to cover more upfront expenses. A lower deductible offers peace of mind but may cost more over time.

The best approach is to evaluate your budget, risk tolerance, and claim history—and adjust as your situation changes. With the right strategy, you can secure coverage that protects your finances without overpaying.