Introduction

Floods pose a serious—but often underestimated—threat to property safety and financial security. In the United States, flood insurance isn’t just a voluntary layer of protection—it’s a critical requirement under multiple circumstances. This article demystifies what flood insurance entails, who must carry it, how much coverage is needed, and why every property owner should consider it—even if not legally obligated.

What Is Flood Insurance and Why It Matters

- What it covers

Flood insurance protects against damage from floodwaters—like rising rivers, storm surges, or heavy rainfall—not typically covered under standard homeowners policies FloodsmartAP News. - Why it matters

FEMA reports 90% of U.S. natural disasters involve flooding FloodsmartAP News. Alarmingly, nearly 32% of NFIP claims come from properties outside designated high-risk zones Floodsmart.

Who Is Required to Have Flood Insurance

1. Homes/Businesses in Special Flood Hazard Areas (SFHAs)

FEMA-designated SFHAs (zones A, V, AE, etc.) carry the highest flood risk Wikipedia.

- If your property lies in an SFHA and you have a government-backed mortgage — such as FHA, VA, USDA, or loans backed by Fannie Mae/Freddie Mac — then flood insurance is mandatory FEMAInvestopediaWikipedia.

- Even private lenders may require coverage regardless of zone FloodsmartInvestopedia.

2. Properties with Past Federal Disaster Aid

If a property has previously received FEMA or SBA disaster assistance, flood insurance must be maintained for future eligibility—even if the homeowner changes Floodsmart.

3. Special Areas (CBRS/OPA)

Properties within Coastal Barrier Resources System (CBRS) or Otherwise Protected Areas (OPA) require flood insurance—even if not in an SFHA—when using a loan secured by the property Selling Guide.

4. Exceptions

Loans under $5,000 with repayment within one year, and certain self-insured state loans, are often exempt Federal Reserve.

How Much Flood Insurance Is Required

NFIP Coverage Limits

- Residential structures: Up to $250,000

- Contents (personal property): Up to $100,000 IIIBankrate

- Commercial properties: Up to $500,000 for both structure and contents III

Lender or Act Requirement

You must have at least the lesser of:

- Outstanding loan balance

- Replacement cost of the structure

- NFIP maximum limit HelpWithMyBank.govFederal ReserveBankrate

Lenders may also “force-place” additional coverage beyond the minimum HelpWithMyBank.gov.

Where Flood Insurance Comes From

1. National Flood Insurance Program (NFIP)

- Established by Congressional action in 1968 and managed by FEMA Wikipedia+1.

- Allows residents in participating communities to purchase flood insurance. More than 22,000 communities participate FEMAWikipedia.

2. Private Market Options

For coverage beyond NFIP ceilings, homeowners can turn to private insurers—though policies may cost more and carry higher deductibles BankrateAP News.

3. Waiting Period

NFIP policies generally have a 30-day waiting period before they take effect—unless coverage is mandated by a lender or due to map changes FEMA.

Challenges and Realities

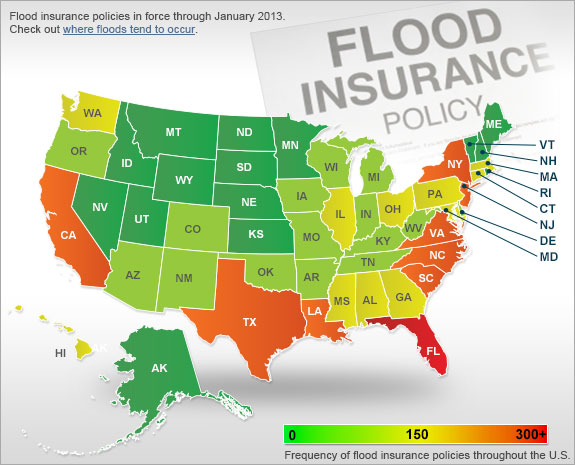

- Low Adoption Rates

Flood insurance adoption is low:- Only about 6% of U.S. households have flood coverage AP News.

- In some areas, like Kerr County, Texas, fewer than 5% of homes in high-risk zones had flood insurance before devastating flooding in 2025 Houston Chronicle.

- Evolving Risks & Maps

FEMA updated many flood maps in 2024, increasing high-risk designations—especially in South Florida. Many homeowners remained oblivious to these changes Investopedia. - Coverage Gaps

Distinguishing flood from wind damage can lead to denied claims, especially where standard home insurance overlaps with flood policies AP News.

How to Comply & Reduce Risk

- Check Your Flood Zone

Use FEMA’s Flood Map Service Center to confirm if your home lies in an SFHA or CBRS/OPA Selling GuideBankrate. - Talk with Your Lender or Agent

Understand coverage requirements if you have a mortgage or received past disaster aid FloodsmartInvestopedia. - Consider Supplemental Coverage

If your home exceeds NFIP limits, ask about excess policies with private insurers Bankrate. - Act Early

Plan ahead—you’ll typically wait 30 days for your flood policy to begin FEMA. - Update Coverage After Map Changes

If FEMA revises maps making your zone higher risk, update or secure coverage immediately for compliant protection InvestopediaFEMA.

Conclusion

Understanding flood insurance requirements in the USA is essential for financial resilience and regulatory compliance. Whether mandated due to your location in a high-risk area, a lender’s requirement, or previous federal aid, flood insurance protects against disasters that standard policies don’t cover.

Take action now:

- Confirm your flood zone.

- Speak with your lender or insurer about required coverage.

- Ensure sufficient, timely, and continuous protection for your home.

By staying informed and proactive, you safeguard both your property and peace of mind.

Internal Links

- How to Understand Flood Zones and FEMA Maps

- Tips for Choosing the Right Home Insurance

- Steps to Prepare Your Home for Flood Risk

External Links

- FEMA National Flood Insurance Program and requirements FEMAWikipedia

- Investopedia article on lender-required flood insurance rules Investopedia